Payment Software Integration

Building the Bridge Between Payment Software and POS Solutions

Many payment service providers (‘PSPs’) are currently seeking to extend their reach from eCommerce to traditional ‘bricks and mortar’ retail by developing payment software integrations. When doing so, they find themselves confronted with an unfamiliar landscape: one where transactions originate on hundreds of point of sale (‘POS’) devices as opposed to from one central server; where each store needs to be treated as a separate entity; and where payment software must be deployed and maintained across multiple locations and device types.

With over twenty years’ experience of developing, implementing and supporting retail payment systems for physical retail, MWC Partners are ideally positioned to help PSPs bridge this technology and knowledge gap between their payment software and POS solutions.

MWC Partners offer independent consultancy and professional services to many of the world’s leading PSPs. Our dedicated digital payments team design and develop payment software integrations between payment and POS solutions and provide advice in shaping the architecture and processes which underpin successful integrations for the retail store environment.

Our knowledge of the retail and payment industries and of their different technologies, along with our understanding of the challenges posed by traditional ‘bricks and mortar’ retailers, mean that we understand how to approach each POS-PSP integration: knowing what the pitfalls are, how to avoid them, and how to ensure a successful implementation.

Trends reshaping the retail payments industry

The retail payments market has undergone a rapid transformation over the last ten to fifteen years. The long-established card payment networks such as American Express, Mastercard and Visa, although still dominant in the electronic payments market, have witnessed the emergence of new PSPs offering an extensive range of innovative and industry-disrupting products and services.

These innovations include new business models such as electronic payments services on a SAAS basis; new products such as digital wallets, as offered by Apple Pay and Google Pay; and new systems that enable online money transfers such as PayPal and pay by email link.

Many different factors have led to these relatively recent developments, but, in particular, they have been driven by market de-regulation and consolidation, technological developments and by changing customer preferences.

Market de-regulation and consolidation

After decades of domination by the banks, specialist payments companies such as Worldpay, Worldline, Nexi and Adyen are now at the forefront of the digital payments market. This transformation, which has taken place within a relatively short timeframe, reflects the issues experienced by many traditional banks in adapting to new market challenges such as the commoditisation of certain payment activities (e.g. processing and acquiring) and the need to offer e-commerce and m-commerce capabilities in the move towards omni-channel retail (Oliver Wyman, 2018).

Success in the payment services industry is predicated not only on scale in individual markets, but also across markets. As a result, the major players have sought to build first a regional and then a global presence. This trend, and the prospects of continuing growth in the payments market, have driven consolidation in the industry, financed in part by private equity companies and primarily engineered via mergers and acquisitions.

Worldpay, which grew out of Streamline and which then became the payments processing arm of the Royal Bank of Scotland (‘RBS’), is perhaps the best example of this market trend. It was put up for sale by RBS in 2010 following the 2008 financial crisis and was acquired by two private equity firms. Worldpay was subsequently floated on the London stock market in 2015, only to be acquired by Vantiv in 2017. The newly merged group was itself acquired in 2019 by FIS Global, a large U.S. PSP active in the retail market but with its core activity in the financial sector. Today, Worldpay forms a key pillar in one of the world’s largest payment services companies.

Two major European groupings have also emerged following a recent flurry of mergers and acquisitions activity. The French group, Worldline, has recently acquired Ingenico and Six Payments, thereby creating the largest payments group in Europe, and the Italian based Nexi has acquired rivals Nets and SIA to become a second major European payments group.

Whilst the leading payment groups have focused on building international scale, market deregulation has opened up the industry to new entrants.

The European Payment Services Directive 2 aimed to modernise payment services for the benefit of consumers and businesses, by promoting the development of innovative online and mobile payments, ensuring more secure payments and better consumer protection. This directive paved the way for new Fintech companies with innovative and distinct product offerings to enter the market. Funded by venture capital, they have quickly become established in the payment services market with widespread adoption of their products and services by retailers and consumers. The UK alone had 91 registered payment service providers as of September 2020 (Financial Times, 2020).

Apple Pay and Google Pay, which offer digital wallets to store consumers’ payment information, are good examples of relatively new market entrants. Companies such as Amazon Pay have achieved success by leveraging existing customer bases from other retail businesses, while others such as Klarna (USP: buy now, pay later) have offered new services based on existing infrastructure. PayPal, which gives individuals and businesses the ability to transfer funds electronically, initially grew as a result of its acquisition by eBay, which made the service its preferred payment platform, but is now a major independent payments group.

Technological advances and changing customer preferences

Changing customer preferences – in particular, the increasing trend towards online as opposed to in-store sales – have helped to drive technological advances and innovation within the payments industry.2

By the end of 2019, online sales accounted for 19% of total UK retail sales, which made it the largest eCommerce market in Europe (ONS, 2020). This growth has been accompanied by and is partly a result of high rates of internet access and smartphone adoption in the UK.

However, since 2019, the Covid-19 health crisis has, within a matter of months, had a transformative impact on retail transactions. By October 2020, online transactions had increased to 30% of retail sales in the UK, peaking at 36.2% in December 2020 (ONS, 2020).

Within stores, the mix of payments types used in retail has been changing. Cash has been in long-term decline, accounting for just 19% of UK retail sales in 2019, down from 48% in 2014 (British Retail Consortium, 2020)(UK Finance, 2020). Card use on the other hand – both debit and credit/charge cards – continues to grow, accounting for 80% of retail transactions by value in the UK in 2019 (British Retail Consortium, 2020).

The recent development of mobile technology for in-store and remote payments has been made possible by innovations in near-field communication, biometric authentication, digital wallets and contactless payments. Transactions have shifted towards contactless payments, with customers preferring the ease-of-use and improved hygiene of card and electronic payments, along with having increased confidence in the security of such methods. At the same time, the adoption of other types of payment has accelerated: digital wallets such as Apple Pay and Google Pay are seeing a rise in usage due to the pandemic. For retailers who had not already adopted such systems, many have now discovered a greater need for electronic and mobile commerce solutions. “Consumers have developed new habits that are likely to last.” (Oliver Wyman, 2020).

As well as efficiencies that accrue from scale, PSPs gain competitive advantage by developing new products that help retailers reduce payment frictions: improving user experience at the point of sale and simplifying operations. Innovators and disruptors like Adyen and Klarna, with their portfolio of payment solutions including e-commerce and m-commerce which focus on enhancing value for merchants, show that rapid organic growth is also possible. These companies focus on technology and R&D – necessary to satisfy growing customer expectations, the rise of new technologies such as smartphones and the use of digital wallets, NFC and beacons, and security requirements such as scoring, authentication and tokenization.

Market opportunities for payment service providers

PSPs need to increase the volume of transactions and their market share in order to grow and to amortize the cost of their technology investments. The major PSPs have sought growth through scale, setting up operations in geographical regions, or even globally. At the lower end of the payment systems market, multiple new disruptors have entered with innovative solutions and have quickly become established as significant players.

For those PSPs which have launched and evolved as online payment processors, physical retail, which still accounts for two thirds of retail sales, is the obvious target market for growth. There are two distinct market entry strategies available here: work with existing eCommerce customers to extend the PSP’s offering to the customer’s stores as well, thus providing one payment solution for all of a retailer’s sales channels; and, secondly, develop relationships with established and widely deployed POS solution providers.

Now more than ever, customers expect to be able to buy online, instore and from their mobile phones, and for the experience to be seamless whichever channel they use. There is, therefore, a significant market opportunity for PSPs who can provide payment systems to physical retailers as well as to online retailers. By building payment software integrations to integrate their systems with existing POS solutions, PSPs can access two key target markets: those retailers who are looking to replace their existing POS solution and who are likely to opt for new payment software at the same time; and those retailers who are existing users of the POS solution and who might want to change PSP.

PSPs know that having a payment software integration with a given POS solution and their payment system (a ‘payment connector’) enables them to address all existing and future users of a particular POS solution. In the case of leading POS providers with a large installed base, the cost to the PSP of developing a payment connector is small compared to the potential return.

So PSPs which were exclusively online-based are now moving into physical retail to support omnichannel retail so that they can provide complete card services across all payment locations. There is a commercial benefit too for retailers in adopting a single PSP for both online and physical retail operations. It enables retailers to have a single view of the customer across all sales channels, and also improves customer experience and targeted marketing. And consumers’ willingness to hold multiple payment methods gives retailers the opportunity to influence their decisions about which payment method to use.

For PSPs working to serve the needs of retailers’ responding to the challenges of Covid-19, there is a clear need to provide solutions that can be implemented quickly and which go beyond basic payments capabilities. This means offering off-the-shelf solutions to allow retailers to quickly open new stores. It is also an opportunity to differentiate by promoting value-added services, such as loyalty program integration, credit risk services and instant financing at the POS to serve customers changed financial circumstances.

How MWC Partners can help: payment software integration

The challenge for PSPs is to understand physical retail well enough in order to determine how to architect their solutions and how to make their solutions work in the target environment.

MWC Partners help PSPs to understand the issues that physical retailers face and how those issues differ to problems in the online space. We have a deep understanding of the retail IT environment, and we can help PSPs understand the target environment and design and integrate payment systems with retail IT systems. We identify the pieces of the solution that are missing and how to close any gaps.

As PSPs continue to innovate, MWC Partners can advise on new and emerging trends in retail technology. An example is the potential disappearance of payment devices (‘PEDs’) as retailers opt for new solutions such as PIN on glass, where a customer keys their PIN number on a tablet. While the security standards have been defined by the PCI Council, there are still security considerations and concerns and so a behavioural change will be required for customers to accept it. This development has the potential to significantly drive down the cost of payment solutions, removing the need for the purchase and maintenance of hundreds of PEDs.

Recognising these competitive challenges, payment systems stalwarts Ingenico and Verifone are now producing full-size Android tablets that are effectively a scaled-up PED that will also allow POS solutions to be run on them. For smaller retailers with one or two stores, or those running pop-up stores, this can present a cost-effective solution.

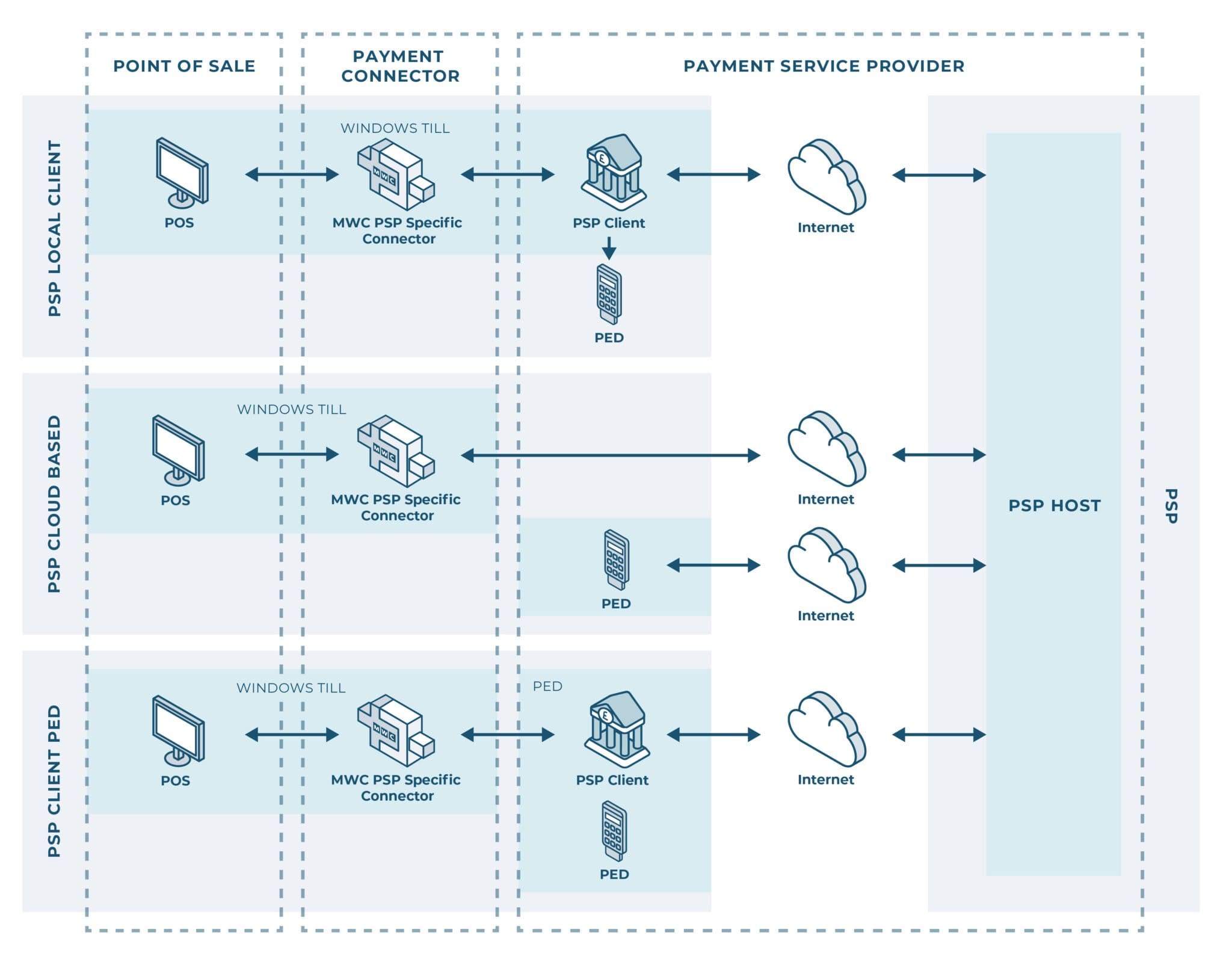

The diagram below illustrates some of the common solution architectures used in building payment software integrations between POS and payment solutions and where the software is deployed in the system. Whichever architecture is used, MWC Partners design and develop tailored payment connectors to bring online payment systems into the physical retail environment.

Our dedicated payment software integrations team have helped many of the world’s leading PSPs to develop solutions for physical retail. We understand the different solution architectures utilised and the increasing trend over the last couple of years to move some of the core payment software into the cloud. This architecture is used more traditionally in the hospitality sector where wireless PEDs are common. This trend itself is driving the need for more payment connectors.

MWC Partners are here to assist you in building that bridge between your payment software and POS solutions in the physical retail world.